不知怎的,這個視頻卻沒有任何觀看次數,然而 $qto 卻進行了將近 100 萬美元的回購,且市場流通市值遠低於你在 DEX 螢幕上看到的。

在某個時刻,@quanto 將會因為他們的飛輪效應而進行 $hype $gp $bonk 的向上蠟燭,因為隨著越來越多的人使用它來進行槓桿交易或在主要幣種上做多做空,回購和燒毀代幣的過程只會加速。

我可以告訴你一件事,非 KYC 的永久合約 DEX,擁有良好的 UI/UX、可觀的交易量和開放的持倉,並且在某個代幣上有很大的上行潛力,正是鯨魚們所喜愛的,因為他們可以隨意購買主要幣種並進行大規模的多頭或空頭交易,而 $qto 的飛輪效應則對他們有利。

我已經參加過 @notthreadguy 的直播,我可以向你保證 @zhusu 的集團在亞洲有影響力,這是加密貨幣的新範式(是的,西方與東方的競賽已經開始)。

大多數人在 $sol 上進行自由交易,但人們懶得再做一次研究。

我可不是那樣。

$QTO @QuantoTrade perpetual non KYC dex (rebrand OXFUN)

quantoL84tL1HvygKcz3TJtWRU6dFPW8imMzCa4qxGW

I bought a bag of $QTO, reasoning below:

Let’s compare it $Hype, $dYdX, $Aevo, Level Finance.

Quanto $QTO

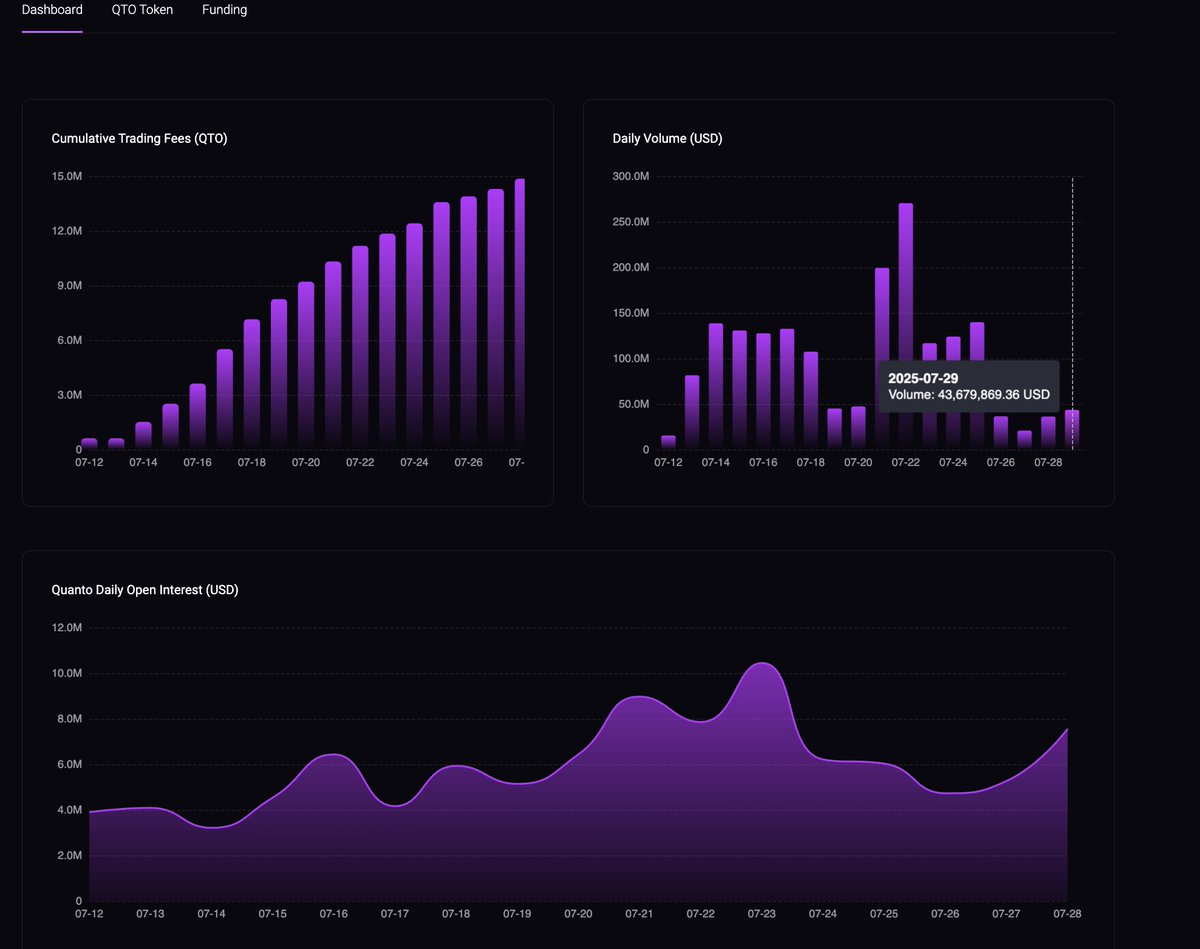

$43M daily volume

$7.5M open interest

No KYC

Source:

Fluctuation obviously, but I took today, which is slightly below average, I assumed this looking at the data (not a lot of data spots though, that's what happens when you are early, we need upwards volume and OI over time)

Let's assume any market cap <$30M for $QTO

Hyperliquid ( $HYPE )

- $12B daily volume

- $10.6B open interest

- Token launched late 2024

- Market cap: ~$15B

- On its own L1

Basically, the Uniswap of perps now

They own ~75% of the on-chain perp DEX volume.

$dYdX

- $500M volume

- $180M OI

- FDV: ~$1.5B

- On $atom

- Battle-tested, but fading slightly in hype

Still a strong player, but not dominating anymore.

$Aevo

- $60M volume

- $25M OI

- FDV: ~$500M

- Perps + options

- Optimism-based

Kinda underrated, but volume still not explosive.

$lvl

- $15M volume

- $5M OI

- FDV: ~$75M

- On $BNB chain

OG DEX with loyal fans

Small but solid.

Compare this to a new (rebranded, shiny) player $QTO, advised by @zhusu $QTO (could use his network to get exposure on X etc, for example @smartestmoney_ one of the best if not best perp traders in crypto follows @QuantoTrade and there are others like @GiganticRebirth)

If FDV is <$30M, then:

- Volume/FDV = 1.4x to 4.3x

- OI/FDV = 0.25x to 0.75x

Based on source:

That’s better than Aevo, Level, and dYdX on a per-dollar basis.

Even stacks up surprisingly well next to Hyperliquid.

Now, $hype is clearly the king, and that won't change anytime soon.

- $12B vol on $15B market cap = 0.8x

- $10.6B OI on $15B = 0.7x

Insane liquidity + usage. Institutions, whales, degens—all in.

But $QTO is showing similar ratios at a microcap scale.

Besides all of this, they are currently buying back tokens daily, basically buying the equity.

They bought back 506k usd as of now, still + 200k usd in their wallet: JBShwQbkqq9dUM6VCKHT5hiWF6hiD7VgxTbkCGsgWXSw

- 21% supply is in a custody wallet

- Team has a 20% alloc vested.

- 20% alloc is reserved.

If they don't sell any of this, just as the buyback wallet then 67% is out of circulation, so circ mcap is give or take 33% -> = 0.33 x 18.2 = 6m usd (lol)

Another good thing is that the UI is actually really great, and some perp trades I know really enjoy the smoothness of the platform.

Obviously, there are some risks with failed/mismanaged projects in the past, that's why I think it's currently flying at a much lower mcap.

Bottom line:

My thesis is that if Quanto’s numbers are organic and sustainable, it’s undervalued compared to Aevo, Level, and maybe even dYdX.

If they keep growing, this could be the best low-cap perp DEX play right now.

X

Shark

1.82萬

7

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。